Free Ad-Supported TV (FAST): Complete Guide for Publishers and Ad Operations

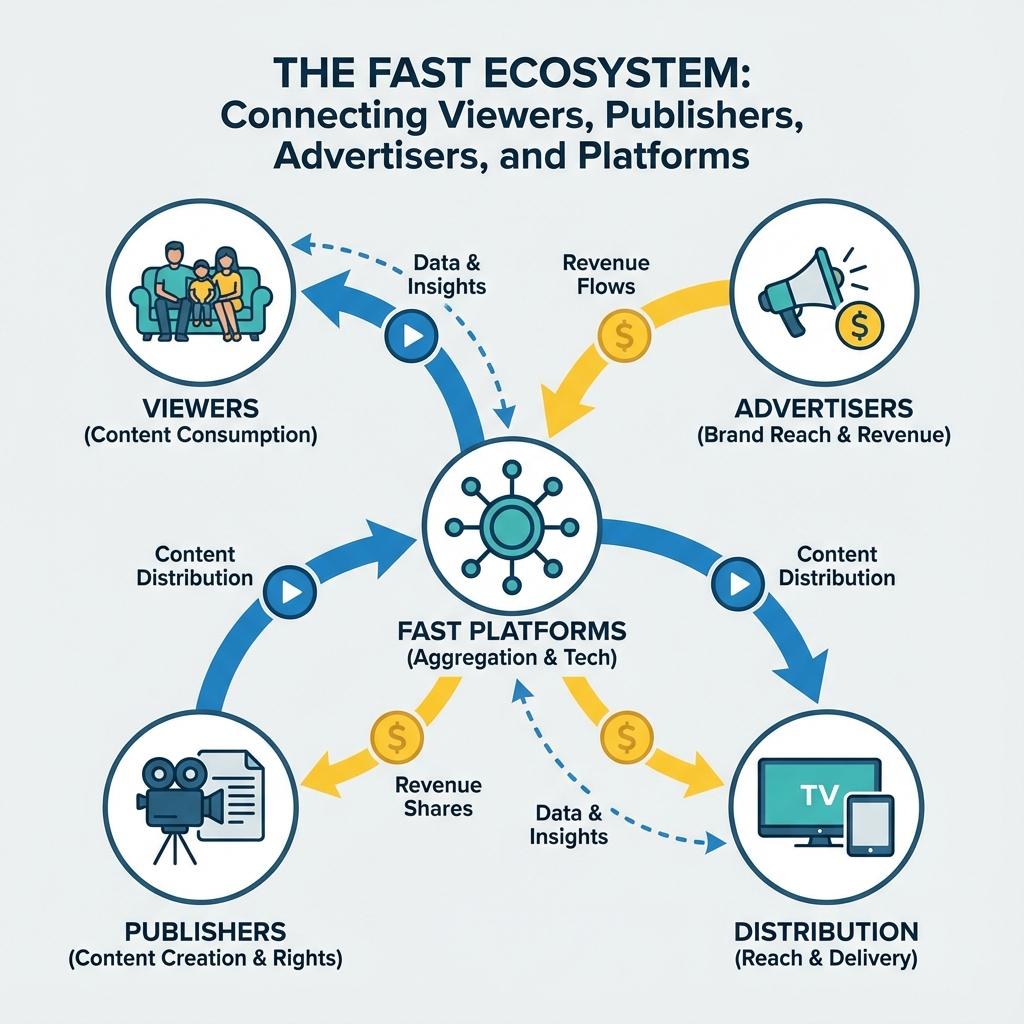

Free Ad-Supported Television (FAST) has emerged as one of the most significant trends in digital media, fundamentally reshaping how publishers monetize video content and reach audiences. As traditional linear TV viewership continues to decline and streaming services face subscription fatigue, FAST channels present a compelling middle ground that benefits both viewers seeking free content and publishers looking for new revenue streams.

What is Free Ad-Supported TV (FAST)?

Free Ad-Supported TV refers to streaming television services that provide viewers with access to content at no cost in exchange for watching advertisements. Unlike subscription-based streaming services (SVOD) or pay-per-view models (TVOD), FAST channels operate on an advertising-supported model similar to traditional broadcast television, but delivered through internet protocols.

FAST channels typically feature:

- Linear programming schedules with continuous content streams

- Commercial breaks integrated into the viewing experience

- No subscription fees or viewer registration requirements

- Content ranging from classic TV shows and movies to original programming

- Multiple genre-specific channels within a single platform

Key Characteristics of FAST Channels

FAST services distinguish themselves through several defining features. They maintain linear programming schedules, meaning viewers tune into predetermined content rather than selecting from an on-demand library. This approach mimics traditional television viewing habits while leveraging the reach and targeting capabilities of digital advertising.

The advertising integration in FAST channels is sophisticated, utilizing programmatic advertising technologies to deliver targeted commercials based on viewer demographics, behavior, and preferences. This creates more valuable inventory for advertisers compared to traditional broadcast television.

The FAST Market Landscape

Major FAST Platforms

The FAST ecosystem includes several major players, each with unique positioning and content strategies:

Pluto TV leads the market with over 250 channels and has established itself as the gold standard for FAST services. Owned by Paramount, Pluto TV combines licensed content with original programming across diverse categories.

Tubi, owned by Fox Corporation, focuses heavily on on-demand content while incorporating FAST channels. The platform has shown remarkable growth, particularly among younger demographics.

The Roku Channel leverages Roku’s dominant position in connected TV hardware to distribute FAST content directly to millions of households.

Samsung TV Plus comes pre-installed on Samsung smart TVs, providing immediate access to FAST content for new TV purchasers.

IMDb TV (now Amazon Freevee) combines Amazon’s content library with targeted advertising capabilities.

Market Growth and Projections

Industry analysts project significant continued growth for the FAST sector. According to various reports, the global FAST market is expected to reach billions in revenue by 2026, driven by increasing cord-cutting, advertiser demand for premium video inventory, and consumer acceptance of ad-supported models.

The growth is particularly pronounced in North America, where cord-cutting has accelerated, but international markets are also showing strong adoption rates as broadband infrastructure improves globally.

Technical Infrastructure for FAST Channels

Content Delivery and Management

Implementing a successful FAST channel requires robust technical infrastructure covering content ingestion, encoding, delivery, and monetization. Publishers must establish reliable content delivery networks (CDNs) capable of handling high-volume streaming traffic with minimal latency.

Content management systems for FAST channels need to support:

- Automated scheduling and playlist management

- Real-time content switching and failover mechanisms

- Multiple video quality streams for adaptive bitrate delivery

- Integrated advertising insertion capabilities

- Comprehensive analytics and reporting tools

Server-Side Ad Insertion (SSAI)

Server-Side Ad Insertion represents the technical backbone of FAST monetization. SSAI technology seamlessly integrates advertisements into the video stream at the server level, preventing ad blocking and creating a television-like viewing experience.

SSAI implementation requires:

- Real-time video processing capabilities

- Integration with programmatic advertising platforms

- Dynamic ad request and insertion logic

- Quality assurance for seamless transitions

- Fallback mechanisms for ad delivery failures

For publishers exploring video player solutions that support FAST requirements, platforms like Veedmo offer comprehensive tools for managing ad-supported streaming content with built-in SSAI capabilities.

Programmatic Integration

Successful FAST channels integrate with programmatic advertising ecosystems to maximize revenue. This involves connecting with Supply-Side Platforms (SSPs), implementing header bidding for video, and ensuring compatibility with major Demand-Side Platforms (DSPs).

Key technical considerations include:

- Real-time bidding latency optimization

- Ad creative specifications and compliance

- Viewability measurement implementation

- Brand safety and content categorization

- Frequency capping and audience targeting

Monetization Strategies for FAST Publishers

Revenue Model Fundamentals

FAST channels generate revenue primarily through advertising, but successful publishers employ multiple monetization strategies to optimize yield. The primary revenue streams include:

Pre-roll, Mid-roll, and Post-roll Advertising: Traditional video ad placements that command premium CPMs due to the lean-back viewing experience similar to linear TV.

Sponsorship and Branded Content: Channel sponsorships and branded content integration provide additional revenue opportunities while enhancing viewer experience through relevant brand partnerships.

Data Monetization: Anonymous viewer data and viewing patterns create valuable audience insights that can be monetized through data partnerships and enhanced targeting capabilities.

Advertising Inventory Optimization

Maximizing FAST channel revenue requires sophisticated inventory management. Publishers must balance ad load with viewer experience, typically maintaining ad loads between 8-12 minutes per hour to remain competitive with traditional television.

Effective inventory optimization strategies include:

- Dynamic ad pod length adjustment based on content and audience

- Premium placement identification and pricing

- Seasonal and daypart-based pricing strategies

- Audience segment-specific inventory packaging

- Cross-channel promotion and house ad utilization

Programmatic vs. Direct Sales

Successful FAST publishers typically employ hybrid monetization approaches combining programmatic advertising with direct sales. Programmatic advertising provides efficient fill rates and access to demand from multiple sources, while direct sales enable premium pricing for high-value advertiser relationships.

Direct sales advantages include:

- Higher CPMs for premium inventory

- Better advertiser relationships and feedback

- Custom campaign development opportunities

- Guaranteed revenue through upfront commitments

Programmatic benefits include:

- Automated inventory management

- Access to global advertiser demand

- Real-time optimization and yield management

- Reduced sales overhead and operational complexity

Content Strategy and Licensing

Content Acquisition Approaches

FAST channel success heavily depends on content strategy and acquisition. Publishers typically pursue multiple content sourcing approaches:

Licensed Content: Acquiring rights to existing television shows, movies, and digital content provides established audience appeal but requires significant licensing investments.

User-Generated Content: Curating and licensing user-generated content offers cost-effective programming options, particularly for niche audiences and emerging demographics.

Original Productions: Creating original content specifically for FAST distribution enables unique positioning but requires substantial upfront investment and production capabilities.

Content Partnerships: Collaborating with content creators, production companies, and other media organizations can provide access to diverse programming while sharing costs and risks.

Programming Strategy

Effective FAST channel programming balances audience engagement with advertiser-friendly content. Successful channels often focus on:

- Genre-specific programming that attracts defined audience segments

- Binge-worthy content that encourages extended viewing sessions

- Nostalgic content that appeals to specific demographic groups

- News and information programming that drives regular viewership

- Seasonal and event-based programming that capitalizes on trending topics

Audience Development and Engagement

Discovery and Distribution

FAST channel success requires effective distribution and discovery strategies. Publishers must secure placement on major streaming platforms, smart TV operating systems, and connected device ecosystems.

Key distribution considerations include:

- Platform-specific technical requirements and certification processes

- Revenue sharing terms and exclusivity arrangements

- Marketing and promotional support from distribution partners

- International expansion and localization requirements

- Cross-platform viewing experience consistency

Viewer Retention Strategies

Retaining viewers in the FAST environment requires understanding the lean-back viewing experience and optimizing for extended engagement. Successful strategies include:

Playlist Optimization: Creating compelling content flows that encourage continued viewing through strategic programming transitions and complementary content pairing.

Personalization: Implementing recommendation engines and personalized channel suggestions based on viewing history and preferences.

Social Integration: Incorporating social media elements and community features that enhance viewer engagement and encourage sharing.

Cross-Promotion: Leveraging multiple channels within a FAST network to cross-promote content and build audience loyalty across the entire portfolio.

Analytics and Performance Measurement

Key Performance Indicators

FAST channel performance measurement requires comprehensive analytics covering audience engagement, advertising effectiveness, and revenue optimization. Critical metrics include:

Audience Metrics:

- Average viewing duration and session length

- Channel retention and return viewership rates

- Audience demographic composition and geographic distribution

- Peak viewing times and seasonal patterns

Advertising Metrics:

- Ad completion rates and viewability scores

- CPM trends and fill rate optimization

- Advertiser retention and campaign performance

- Revenue per viewer and lifetime value calculations

Technical Metrics:

- Stream quality and buffering incidents

- Ad insertion success rates and error monitoring

- Platform-specific performance variations

- CDN performance and geographic delivery optimization

Data-Driven Optimization

Successful FAST publishers leverage analytics for continuous optimization across content, advertising, and technical operations. This includes:

- A/B testing different content arrangements and advertising loads

- Automated optimization algorithms for ad placement and pricing

- Predictive analytics for content acquisition and scheduling decisions

- Real-time performance monitoring and alert systems

Regulatory and Compliance Considerations

Privacy and Data Protection

FAST channels must comply with evolving privacy regulations including GDPR, CCPA, and other regional data protection laws. This requires implementing:

- Transparent privacy policies and consent management

- Data minimization and retention policies

- User rights management including access and deletion requests

- Third-party vendor compliance and data sharing agreements

Content and Advertising Standards

Compliance with broadcasting standards and advertising regulations ensures channel sustainability and advertiser confidence. Key areas include:

- Content rating and age-appropriate advertising

- Closed captioning and accessibility requirements

- Political advertising disclosure and fairness requirements

- International content and advertising standards for global distribution

Future Trends and Opportunities

Emerging Technologies

Several technological developments will shape the future of FAST channels:

Advanced Targeting: Machine learning and AI will enable more sophisticated audience targeting and personalization while respecting privacy requirements.

Interactive Advertising: Shoppable ads and interactive experiences will create new revenue opportunities and enhanced viewer engagement.

5G and Edge Computing: Improved network infrastructure will enable higher quality streaming and more sophisticated real-time features.

Market Evolution

The FAST market continues evolving with increasing competition and consolidation. Publishers should anticipate:

- Greater emphasis on original and exclusive content

- International expansion and localization opportunities

- Integration with broader media and entertainment ecosystems

- Enhanced measurement and attribution capabilities

- Continued growth in connected TV and streaming adoption

Conclusion

Free Ad-Supported TV represents a significant opportunity for publishers and ad operations professionals to capitalize on changing viewer preferences and advertising market dynamics. Success requires comprehensive understanding of technical infrastructure, monetization strategies, content acquisition, and audience development.

Publishers entering the FAST space must balance multiple considerations including content costs, technical complexity, regulatory compliance, and competitive positioning. However, the growing market demand, advertiser interest, and proven revenue models make FAST channels an attractive addition to diversified digital media portfolios.

The key to FAST channel success lies in executing a well-planned strategy that addresses all aspects of the ecosystem, from technical implementation and content strategy to monetization optimization and audience development. As the market continues maturing, early movers who establish strong foundations will be best positioned to capitalize on the ongoing growth and evolution of free ad-supported television.